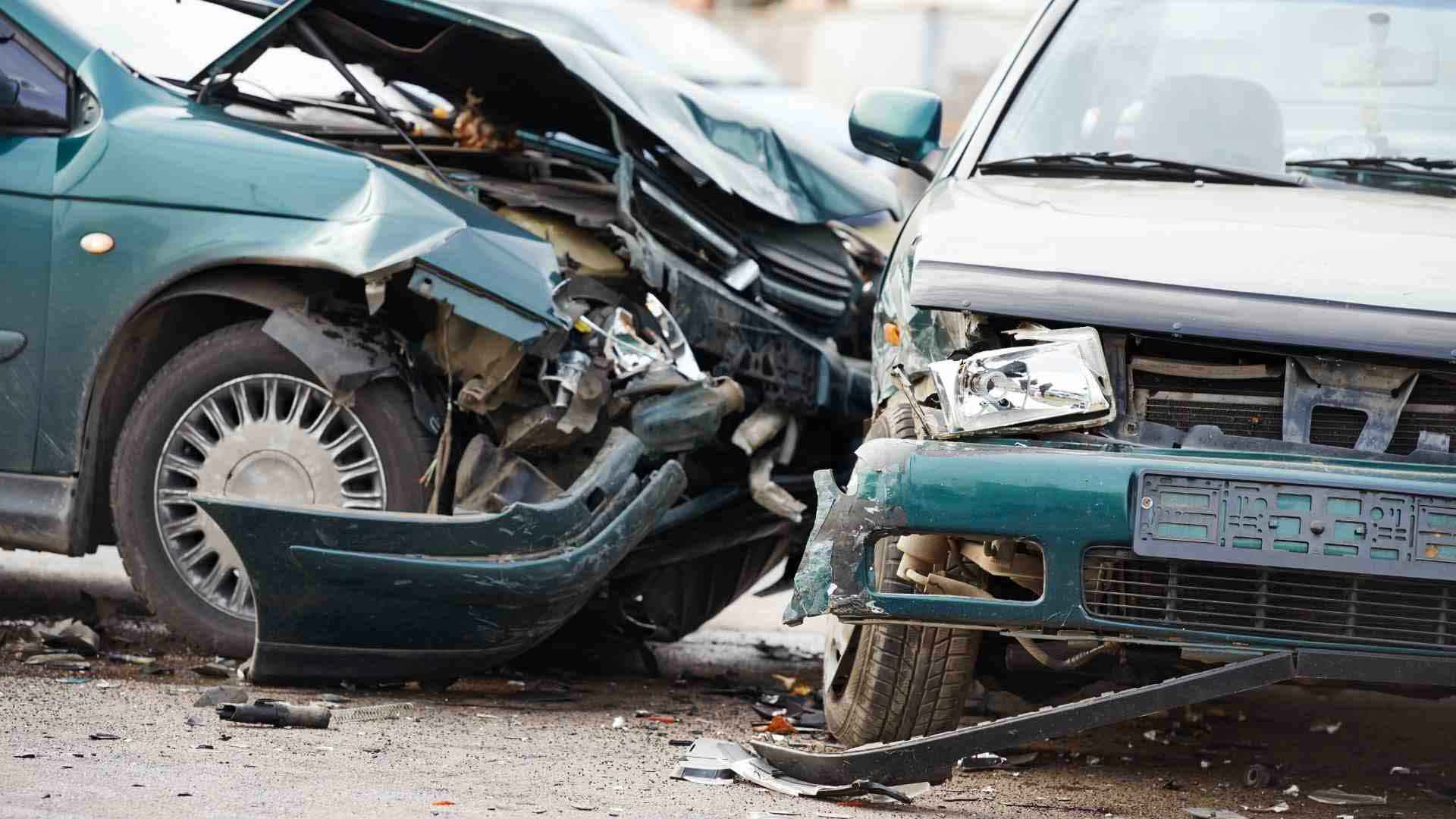

If you are involved in a car accident that is not your fault, you are obviously entitled to some kind of financial compensation. At a minimum, you can expect your car to be either repaired or replaced and for your medical bills to be taken care of. Depending on the severity of the accident itself, however, there are quite possibly other financial considerations to take into account. This can include time off work, pain and suffering, missed opportunities, driving expenses back and forth to the doctor’s office, and much more. Because of this, it is not always a wise idea to accept payment from the at-fault driver or his or her insurance company. Let us explain why briefly below.

Insurance Companies Tend to Underestimate the Actual Cost of an Accident

It should come as no surprise that insurance adjusters are actually under pressure to offer you a check following an accident that is for far less than you likely deserve. This is because their job is to represent their shareholders and to earn as much profit as possible. This goes for an at-fault driver that is trying to circumvent the insurance companies by offering you a payment directly. While you may admire their willingness to take responsibility, is important to take a step back and consider the actual cost of the accident.

To begin with, many injuries that accompany a car accident do not manifest themselves for a few days or weeks after the fact. Some of those injuries will take quite some time to recover from, meaning time off work is almost certain, and the cost of driving back and forth to medical appointments must be taken into account. Because of these factors alone, it is simply difficult to estimate the financial toll of a car accident right after the collision itself. An insurance company knows this, and that is why they will often offer drivers a quick payment if their insured is determined to be at fault. It is their way of closing the matter and getting them off the hook for future expenses.

Patience is Key

It is true that failing to accept an initial payment from either the at-fault driver or the at-fault driver’s insurance company will delay the amount of time that it actually takes for you to receive compensation. If you have insurance yourself, your immediate needs should be met. It is then up to your insurance company if they want to go after the other party for repayment. Beyond that, you will possibly be able to receive additional financial compensation due to the unintended consequences of the accident. This is why you will want to consider consulting with a lawyer in order to determine what your most course of action should be.

Focus on your own physical recovery. Allow your lawyer to deal directly with the at-fault driver’s insurance company. If payment is offered to you, your lawyer is in the best possible position to know if it is enough or not. You will not have to worry about taking into account the full scope of the accident. In addition, your lawyer can work to ensure that your car is either adequately repaired or replaced. Medical bills will be deferred and, as expenses continue to add up, your lawyer will this to negotiate a fair settlement that you are legally entitled to. This all takes time, but if you are patient it will all come to fruition in the end.

What to do Following an Accident

Since we have established that is not usually in your best interest to accept payment from the at-fault driver or the at-fault driver’s insurance company, there are a few things you can do to better position yourself. Make sure that you consult with a lawyer as soon as you are physically able to. This will help ensure that your legal rights are protected. Work to get as much contact information for the other driver and any witnesses as you can. Also, ensure that the police are called to the scene and that a police report is generated.